Few people have been interested in this stock for the past three years, but in just one month, the stock has seen an admirable growth. Trading in silent nearly 3 years, suddenly in November 2017, CMG shares of CMC Corporation has risen stronger than ever, up one circuit to 100%. Ending the trading session on […]

Few people have been interested in this stock for the past three years, but in just one month, the stock has seen an admirable growth.

Trading in silent nearly 3 years, suddenly in November 2017, CMG shares of CMC Corporation has risen stronger than ever, up one circuit to 100%. Ending the trading session on December 11, CMG is priced at 40,000 – the highest historical price to date. The sublimation of shares took place at the same time that CMC Telecom, a member of CMG, launched a new trans-Vietnam route and opened its third data center on December 7th.

A leap?

According to information from the company, Cross Vietnam Cable Network (CVCS) of CMC Telecom has a total length of more than 2,500 km running from Lang Son to Tay Ninh, passing through 19 provinces across the country. The CVCS service has a total investment of more than VND 500 billion and is the only cable system connecting Vietnam directly to the South East Asia A Grid. Accordingly, Vietnam has officially joined the regional network, connecting the countries of Malaysia, Singapore, Cambodia and Thailand.

Together with TIME dotCom, Malaysia’s leading telecom operator, which owns 46% of CMC Telecom, the CVCS service will be connected to the region’s most important ocean-going cables such as APG, AAE. -1, UNITY and FASTER. With the introduction of the CVCS service, businesses in Vietnam and other countries in the world will experience a seamless, seamless and seamless telecommunications infrastructure.

In the report on CMG, analysts have assessed, the North – South optical cable will raise the CMG to a new position. Not only laying a new foundation in the telecom infrastructure, but also in the most direct way, CMG can save a great deal of money with the new cable.

“It is expected that the cable line will be depreciated within 3-5 years, so the depreciation expense is around VND40-65 billion per year, compared to CMG’s estimated line rental expense of VND110-120 billion the company can save about 50-75 billion VND per year “- Bao Viet Securities Company (BVSC) estimated.

The expectation of this jump may have helped CMC achieve such impressive growth.

Unable to compete on price, CMC chose to create differentiated products

CMG now owns three main arterial roads, including the North-South trans-Vietnam optical cable line, the Hanoi-Lang Son cable network, the Ho Chi Minh-Moc Bai cable line, and three international cable links. IA, AAG and APG.

BVSC said that the CMG will soon be connected to FASTER’s world’s fastest cable system when it completes its international traffic with Global Transit. With the development of the infrastructure, CMG will not have to depend on other suppliers as before, which will increase the competitiveness of CMG, help enterprises take a more active role in business activities. its telecommunications.

At present, CMG’s telecom revenue mainly comes from the business line rental and related services. In addition to revenue growth, the costs are also minimized as CMG is able to manage its revenue stream, so profit margins will start to increase this year.

Currently, the telecommunication network of CMG is only 8-9%, lower than the industry average of 15% due to the large leased infrastructure, CMG’s target in the coming years is to reach the EBT margin 15%.

BVSC assesses, CMG’s competitive advantage is the ability to sell its integrated service packages to customers. CMG’s core customers are large scale businesses, requiring high levels of stability and security in the system. CMG also provides other solutions for data security, data, application, management, maintenance … which other major telecommunication enterprises such as VNPT, Viettel, FPT do not.

This is a wise choice for CMG when the company can not compete on price with other telecom companies, so its strategy is to create differentiated products for a segment of customers. be oriented.

Take market share of system integration from FPT

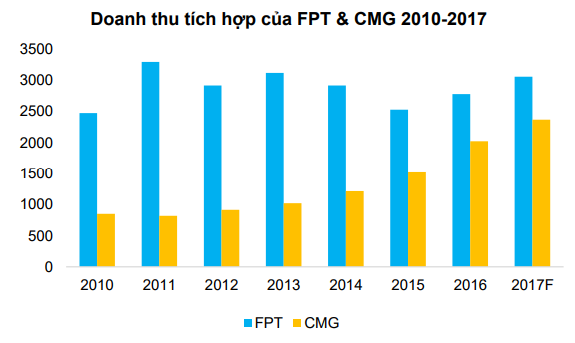

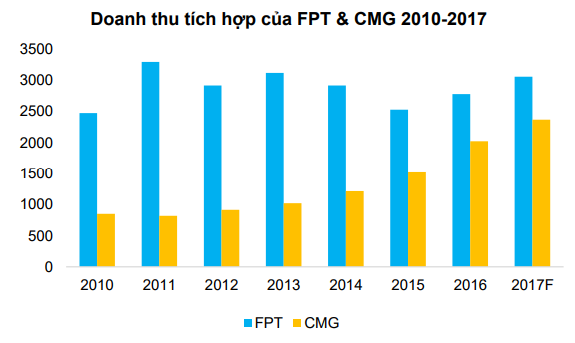

According to an analysis of BVSC, CMG and FPT are currently the two largest system integrators in Vietnam. FPT’s performance in this segment has shown a decline in sales in recent years, while CMG’s revenue has grown steadily. This comes from the development strategy of each party, while FPT’s strategy of globalization has devoted a lot of resources to developing overseas markets, resulting in declining domestic sales, taking advantage of this opportunity. CMG has gained a lot of market share from FPT, increasing market share rapidly.

In this segment, CMG focuses on three key segments: infrastructure services, industry solutions and professional IT services. In the infrastructure services segment, CMG currently owns 4 Data Centers in Hanoi and Ho Chi Minh City. Ho Chi Minh City with the scale of about 1.000m2 per DC with the mission of providing data, server services to customers. The company plans to build a new DC at Tan Thuan with an area of 3,000-4,000 square meters this year, estimated at VND120-160 billion, will be CMG’s largest ever to date. . CMG estimates that each 1,000m2 of DC will generate 90-100bn of revenue, with EBT margin of around 15%.

Soure: http://s.cafef.vn/cmg-243167/bat-chap-thi-truong-do-mau-mot-co-phieu-lang-le-tang-100-khi-gianh-duoc-thi-phan-cua-fpt.chn