If banks do not keep up the process of digitizing will lag far

As predicted, the revenues from traditional banking services will decrease as customers instead of to the counter of the bank will use online banking services on smartphones.

|

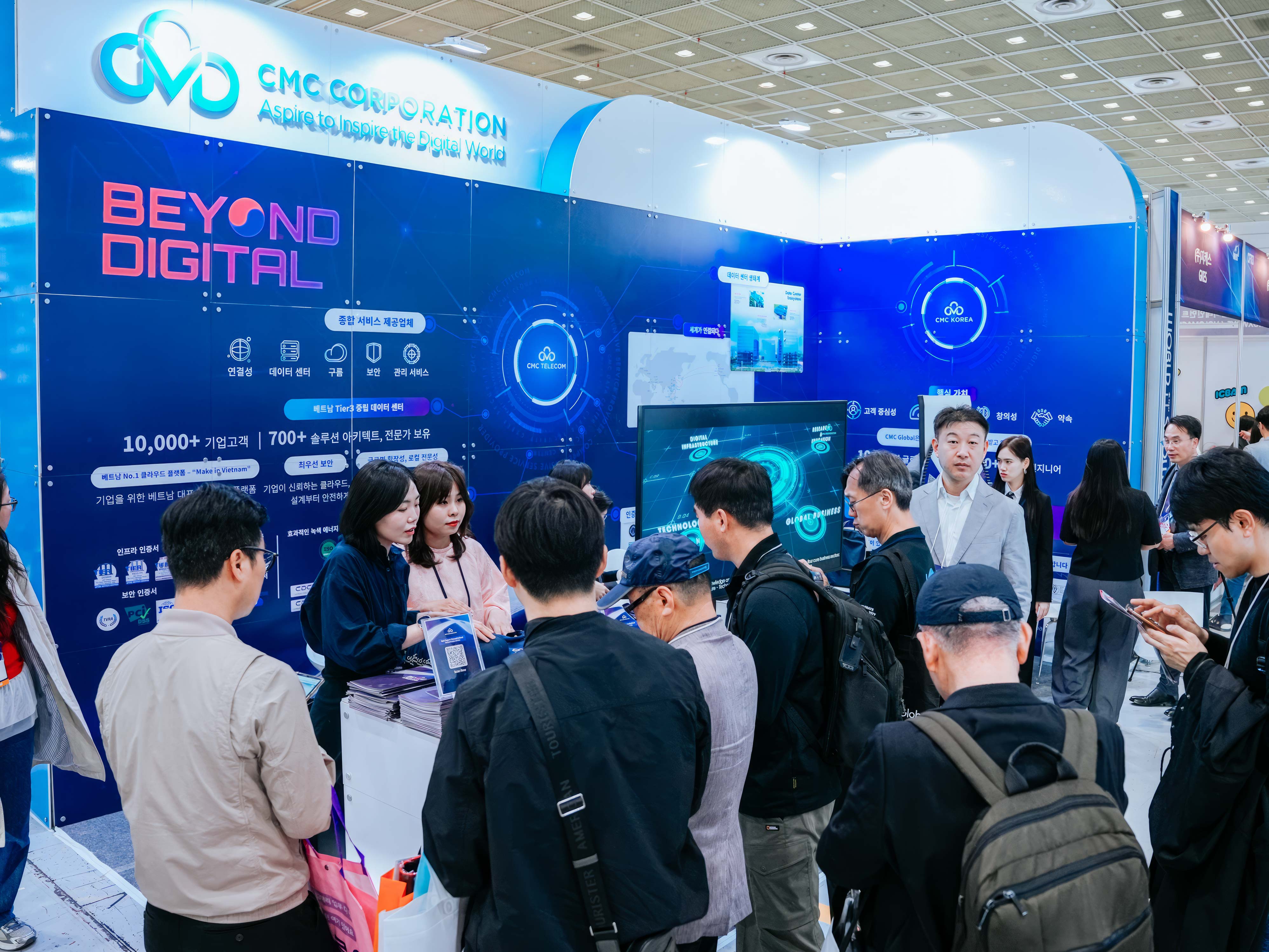

Mr. Adnan Bin Azhar, Marketing Director of CMC Telecom discusses digitization in the bank

|

Technology trends forced banks to change

Banking Vietnam during the event was held in the city. HCM has many experts analyze the challenges of the bank in the process of digitizing the user when the trend is changing very fast. Therefore, the competitiveness of each bank is seen in terms of whether banks including the game’s pioneers in the digitization process or not?

Presented at the event, Mr. Adnan Bin Azhar, Marketing Director of CMC Telecom has launched the previous example, people read newspapers, the switch now they read newspapers online. Previously, people used the camera takes time to switch to camera number. Previously traveling people carrying maps first time smartphone has just installed Google Map. Similarly, former customers to a bank transaction to transaction, then now people use online banking services on smartphones.

According to statistics, the 2016 Vietnam has 52% of people use the Internet. The growth of Internet users in Vietnam are very strong. Besides, the number of smartphone users in Vietnam also grew rapidly. If in 2015 only about 20.6 million people, the 2017 can be up to 28 million people. It is expected that in 2021 Vietnam will have about 40 million smartphone users.

Mr. Azhar Bin Adnan poses problems Where is the way that digital application properly to understand the spending habits of customers and management skills of their money? Explaining further on this issue, CMC Telecom that have the tools to interact directly on the website of the bank and push on the features of Facebook, Google chrome … More and more customers use the service directly instead of traditional methods of banking.

Actual current customer behavior in the banking sector change quickly, they use the Internet to gather information about products and services. Customers can also predict the bank understands their needs and can provide appropriate solutions. Therefore, banks have to redesign products and services to fit the new digital technology trends

However, experts also pointed out that CMC Telecom, banks are faced with security problems before the network attacks, DDOS, Malware …

Seize the opportunity in digital technology trends

The technology experts say, the bank focuses on processes transactions rather than innovative customer experience. The retail banking has been slow in introducing new technology into the core of their processes.

However, under the guidelines of Vietnam provides a roadmap to 2020 limit the use of cash. Specifically, the transaction in cash is less than 10% of total market transactions (in supermarkets, shopping centers …), 70% on utility services, 50% of households in urban . Vietnam has set a target of 70% of Vietnam over 15 years old have a bank account in 2020 and the Government may increase the fee by cash payment and electronic payment reduction.

Obviously, along with technology trends are changing quickly and with undertakings from the Government restricted the use of cash in the transaction would be a great opportunity for the banks if the pioneers in digital technology.

Mr. Azhar Bin Adnan, said that banks need to fully integrate the tools online, mobile and interactive tools to manage monetary simplify and sell the products of the bank. PBX services will help customers solve problems through calls, supported by modern data system (ability to solve problems within the first call). Besides that, the coordination of marketing campaigns online marketing and advertising in the branch.

Banks to guide customers to the site attractive, mobile applications and ATMs in a compelling and highly interactive. Bank branches still play an important role, as one product showroom and where to seek expert financial advice. Banks will gradually cancel the transaction counter staff that replaced with free Wi-Fi, video-conference and entertainment devices digital, display merchandise, mini cafes … the bank will hire and development staff of highly skilled, supported by a customer management system interactive and digital gadgets.

Experts analysis technology that, according to traditional standards of bank activity is based on their geographical branch. However, banks will have to redesign the IT structure based on customer experience rather than geographical location. For example, Citibank Rainbow project in 2014 – a common platform on global bank serving more than 40 countries. In Australia, Citibank can reach more than 1 million customers in only 13 branches.

The bank will collect all customer information online in a customer management system as a core strategic capabilities. For example, the Commonwealth Bank of Australia (CBA) has consolidated the operation of the system from 23 DC (data center) to 2 DC, focusing on the experience of our customers and the appropriate services, to help improve the efficiency and boost customer loyalty.

At the event, Mr. Azhar Bin Adnan also said that technology and the number of customer behavior will change the rules of competition. So, advice to banks “Be always predict potential competitors can come from anywhere”. Banks must provide for the individual needs of our customers and take advantage of the strengths of the bank to build a stronger brand and gain customer loyalty.

Mr. Azhar Bin Adnan said, to accompany the process of digitization, the bank select technology partners and potential reputable technology to accompany her to the digitizing process.

Source: ictnews.vn

Translated by Google