Is not a coincidence that the presentation of Mr. Azhar Bin Adnan, a Marketing Director Malaysian of CMC Telecom, selected the beginning and can say that the report led to the subgroup 2 of the Seminar – Trade Banking Vietnam 2017 exhibition at the City, HCM dated 19-5-2017.

Exhibition Banking Vietnam is an event of banking technology Annual by State Bank of Vietnam and Data Group International (IDG) of US jointly held from 2003 until now to exhibit and introduce the achievements new technology and modern information technology applications in creating the product, new bank services.

In Banking Vietnam 2017 with the theme “Digital technology to promote comprehensive financial in Vietnam “ , thematic depth 2 themed “Digital technology to promote services of modern banking increased accessibility Guest row”. And it was opened with the presentation “Challenges in the field of banking” by CMC Telecom Marketing Director.

Challenge number of banks

Today, the digital content is affecting every corner of society and all aspects of human life. All the way it works has changed the way that people used to say that from the analog to digital conversion. Activities of the bank as well. Also with the transaction, basic services, but rather to make the transaction and working through the papers today, customers can make all transactions using digital technology based on Internet and mobile. With computers and mobile devices, customers can perform banking transactions anytime, anywhere without having to direct contact with the bank facility again. Then with the NFC connection, customers only need to surf smart watches,

Obviously, there is nothing to argue about the banking sector today is facing some challenges. But what specifically? Mr. Azhar Bin Adnan said that the main challenges is the understanding of the capacity of the banks have and should have for it. May raise some common challenges:

– Where is the application of the right to understand the spending habits of customers and management skills of their money? It is the interactive tool directly on the website of the bank; simultaneous push to exploit the features of social networks like Facebook, Twitter, …

– More and more customers using online banking service instead of having to take the bank’s trading desk. The problem arises as the online banking platform trusted how to meet this new trend?

– The behavior of banking customers in the rapidly changing. Customers use the Internet to gather information about products and services. Therefore, banks need to predict and understand the needs of clients to provide the right solution tailored style.

– Network security and safety information. Banks have to start getting ready to prevent and deal with cyber attacks, DDOS, malware, … Once you have become a victim of crime tech, banks not only damage financially but also adversely affected the reputation and brand.

– Redesign of products and services to fit the new digital technology trends.

– Change the way the recruitment, training and deployment of staff where the “frontline”.

Then the most common mistakes that often make the banking sector in the process of adapting to digital technology is what? Mr. Azhar Bin Adnan answered this question by quoting a Bain & Company study: “Focus on processes transactions rather than innovative customer experience. The retail banking has been slow in introducing new technologies directly to customers at the core of its activities. ”

Banking Vietnam 2017 shows more clearly the trend of the era of banking operations today and in the future any more, no longer a service provider that is selling. Banks can no longer wait for customers looking to – because it will take clients on hand all kinds of technology companies financial services – banking Fintech, which have created new services and offerings to take visitors row. Basically, the bank must also retail. And the difference between the bank than is the experience they offer their customers.

According to CMC, the banking sector Vietnam has many advantages to switch to the new generation digital technology. Rate mobile Internet users in Vietnam and at high levels in the region and is growing rapidly. According to data from 2016, Vietnam has more than 49 million people (52% of the population) use the internet. The latest figures show that in 2017, 28.5 million Vietnam smartphone users (ie mobile devices capable of Internet connectivity and implementation of mobile applications). Vietnam government has announced initiatives to become cashless in 2020. Specifically, in 2020 will be 70% of Vietnam over 15 years old have a bank account. The number of transactions in cash only accounted for less than 10% of total market transactions (in supermarkets, shopping centers, …) To encourage people to electronic payments,

According to CMC, the core of meeting the challenges of the banks to seize the favorable opportunity that by empowering customers, enabling customers maximum use digital technologies in all transactions with the bank.

In order to empower the customer, banks must meet four strategic imperatives:

1.Tich of sales distribution channels of the bank.

2. Design the system and the bank branch.

3.Nang level of banking services.

4.Strengthen brand strength of banks.

Sharing customer information

Presentations at Banking Vietnam 2017 emphasizes the role of Fintech in comprehensive financial platform. As noted, at present, about 30% Fintech revenues in financial activities – banking. An important factor in the relationship Fintech – bank customer data sharing. And here, requires security and maximum safety for the process of sharing data.

Ms. Tran Thi Phuong Hong, deputy director of the CMC Saigon, share in Banking Vietnam 2017 that: For years, the CMC is working with banks and many businesses in the share issue, the security of information. Currently tends to put the data into the cloud, and sharing customer data between enterprises and banks. There are 49 million people in Vietnam (more than half of the population) have online activities, of which 80% online every day. Experts predict that by 2020, the number of Vietnamese online will reach 65 million people.

In the current business operations, sharing of information between enterprises and banks is essential to jointly develop. If banks and enterprises themselves hold back their data, neither party will benefit all.

Currently in Vietnam there are 16 companies Fintech. The fact that their activities are not effective, mainly because of the collaboration between companies and banks Fintech not really good. According to Ms. Phuong Hong, firstly, the regulations on coordination of information sharing by the State Bank issued unclear. Second, the company itself has not Fintech create confidence for the banks. Third, many banks tend to yourself all not want to cooperate, thanks to companies Fintech to exploit ability and their work in the expansion of banking activities, as well as creating difference to the customer experience.

Response from CMC

Is a technology company with strengths in security, CMC is providing our customers with solutions and tools for security operations in general and in particular data. The latest attack is an incident of malicious global network WannaCry extortion. CMC has quickly supply patches for businesses to protect themselves. Especially CMC has helped some 100 businesses stuck WannaCry can overcome this disaster. CMC reinforce its hotline system to support customers the highest efficiency possible.

Currently, CMC is building a common security strategy with the consulting firm leading the security operations center (Security Operations Center). For bank customers, CMC will support the construction of the security center of the banking activities in a comprehensive manner from the people, processes to technology. The objective is to help banks can maximum security of customer information, create customer confidence in transactions, especially transactions through the network, including the Internet and mobile. CMC also developed a solution called Realtime Monitoring allows banks can monitor in real time the status of your account and information of each customer, can detect the right customers who are attacked to immediately protect customers.

On the basis can proactively protect customer information, banks can boldly combine with companies Fintech to extended range of their activities make up the channel multimeter omni-channel (multichannel all all in one).

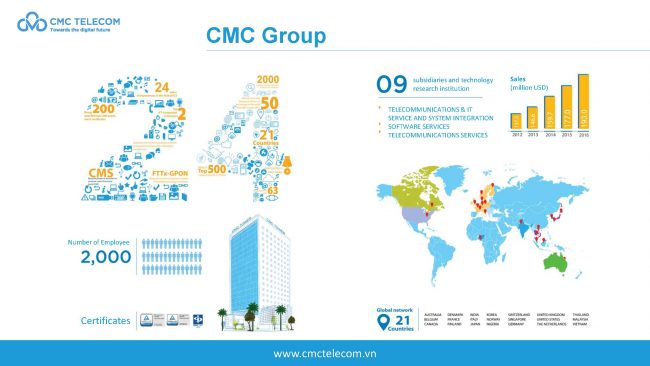

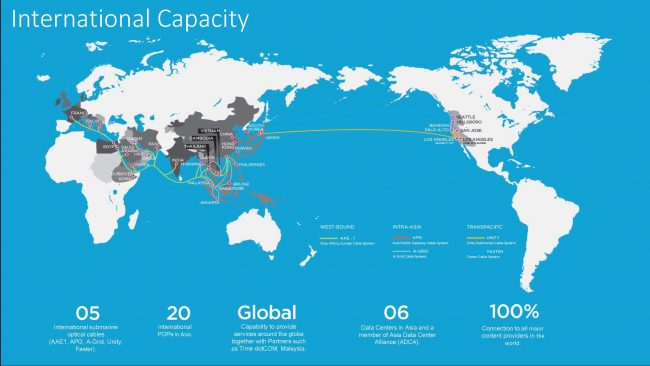

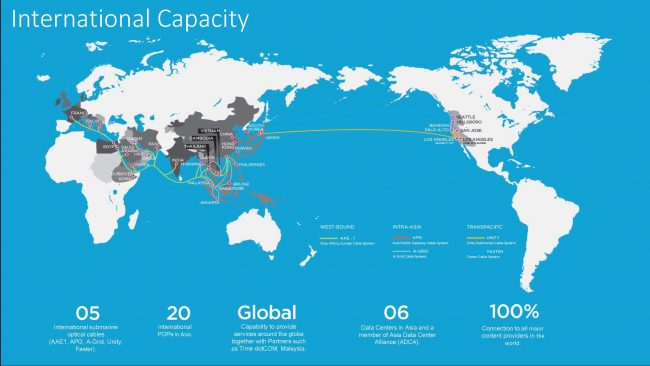

Digital technology based on the Internet today and mobile, no longer limited by time, space and national boundaries. CMC Group has also stretched into an international technology company, now operating in 21 countries with over 2,000 employees. So far, the international capacity of CMC is enhanced with 5 optical cables international Internet running underwater, 20 e-mails POP International, 6 data centers in Asia, connected to all content providers in the world, cooperation with foreign partners to provide services on a global scale, …

CMC also developed the arm now strong in systems integration, telecommunications, software services, … they have chosen for themselves the direction accompanying digital technology with the slogan “Towards a digital future” (Towards the digital future) with the message “the journey numeric data: should not walk alone” (the digital data journey: Do not walk alone “.

It is a necessity and mutual relationship. The future of all human activities must be based on digital technology, based on digital technology and digital data. In the world of all things connected, no one can live alone. And who mastered digital technology and know how to exploit digital technology, that person can be profitable.

Source: mediaonlinevn.com

Translated by Google